Long and Short

Play Both Sides of the Market

An indicator that identifies both long and short can help you take advantage of market volatility, provide a more complete picture of market trends, and give you more flexibility in your trading strategies. This means you can profit from both upward and downward price movements and adapt to ANY market conditions!

Safe Signals

Trade in the Right Direction

Trading with the trend is a proven strategy that can help you reduce risk and increase your chances of success. Safe Signals will help you identify the direction of a trend and align your trades with it

Custom Strategy

Create your Own Trading Signals

Building a custom strategy can help you create a personalized approach that suits your trading style and goals. This can help you improve your performance and achieve better results for the product you are trading.

Get Alerted

Never Miss an Important Event

Receive real-time alerts to keep you informed without constantly monitoring the charts. Perfect for integrating with automated strategies and bots. Stay ahead of market movements with instant notifications, customize your alerts to match your trading style, ensuring you never miss an opportunity

Multiple Stops

Select More Than One Stop

By setting multiple stops, you can protect your trades from unexpected volatility and avoid relying on a single stop that may be too loose. Additionally, trailing stops can help you protect your winnings by adjusting your stops as the trade progresses in your favor. This means you can minimize your risk AND maximize your potential profits.

Multiple Targets

Select More Than One Target

Using more than one target can increase your chances of taking profits. By setting multiple targets, you can take advantage of market volatility and increase the probability of hitting at least one of your targets. This can help you avoid the frustration of missing out on profits with a single target

Position Sizing

Risk Management to Stay Alive

Proper risk management is essential for ANY trader, there is a reason all the pros are doing it. Determine automatically the amount of capital to allocate for each trade based on your risk tolerance and account size. This ensures that no single trade can significantly impact your overall trading capital, protecting you from potential ruin.

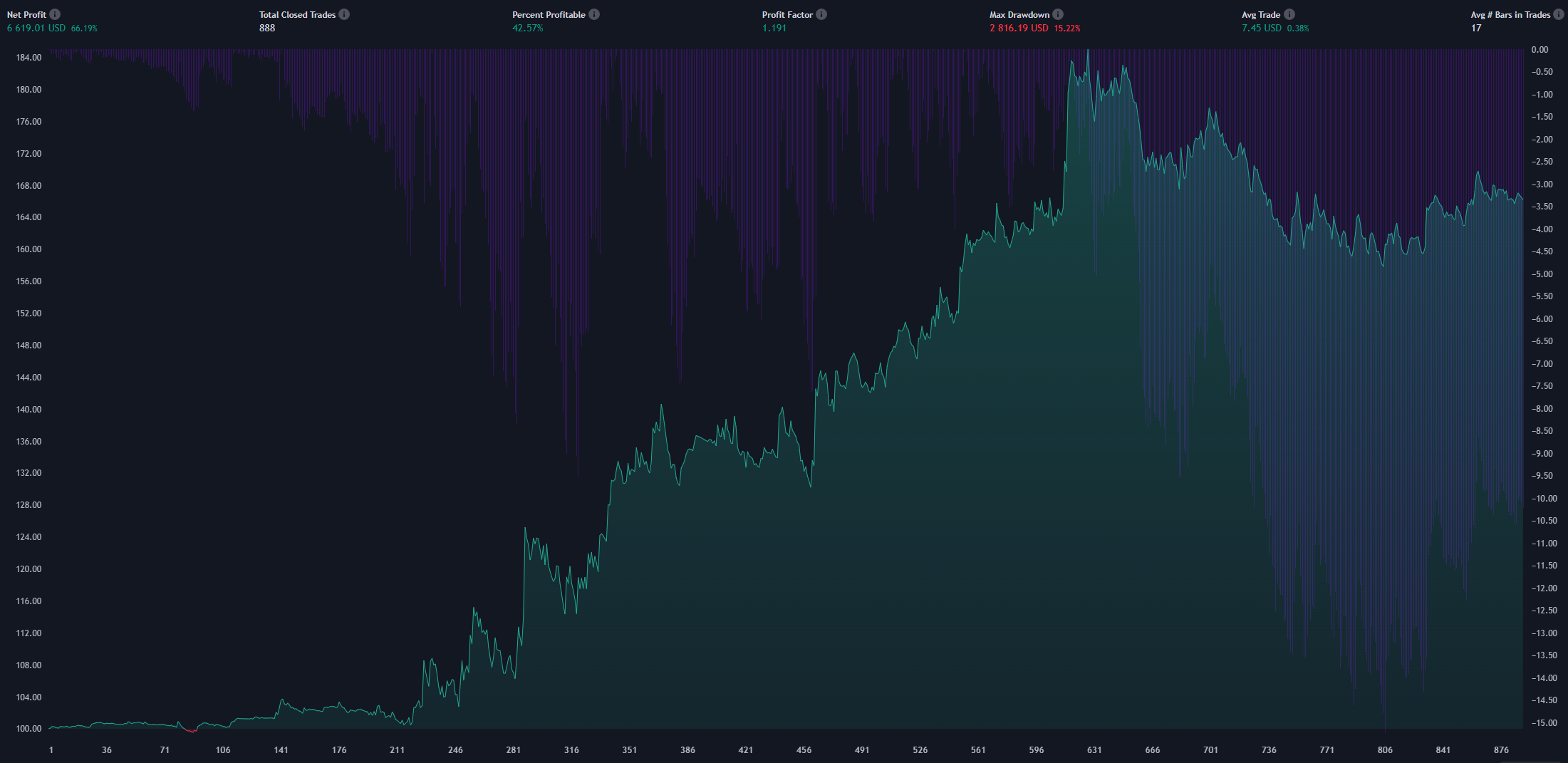

Back-Test

How Your Strategy Performed

Back-testing is a crucial tool for traders. It allows you to simulate the performance of your trading strategy. Unlock the full potential of the indicator, analyze past results, identify strengths and weaknesses, and refine your approach for improved performance. With our Back-testing feature, you can take control of your trading journey and achieve the success you desire

Trade All Markets

Crypto, Stocks, Forex, Commodities

Trading all markets can help you diversify your portfolio and take advantage of more opportunities. By trading a variety of markets, such as Crypto, Stocks, Forex, and Commodities, you can spread your risk and reduce your exposure to any one market. This can help you avoid the pitfalls of being too heavily invested in a single asset class.